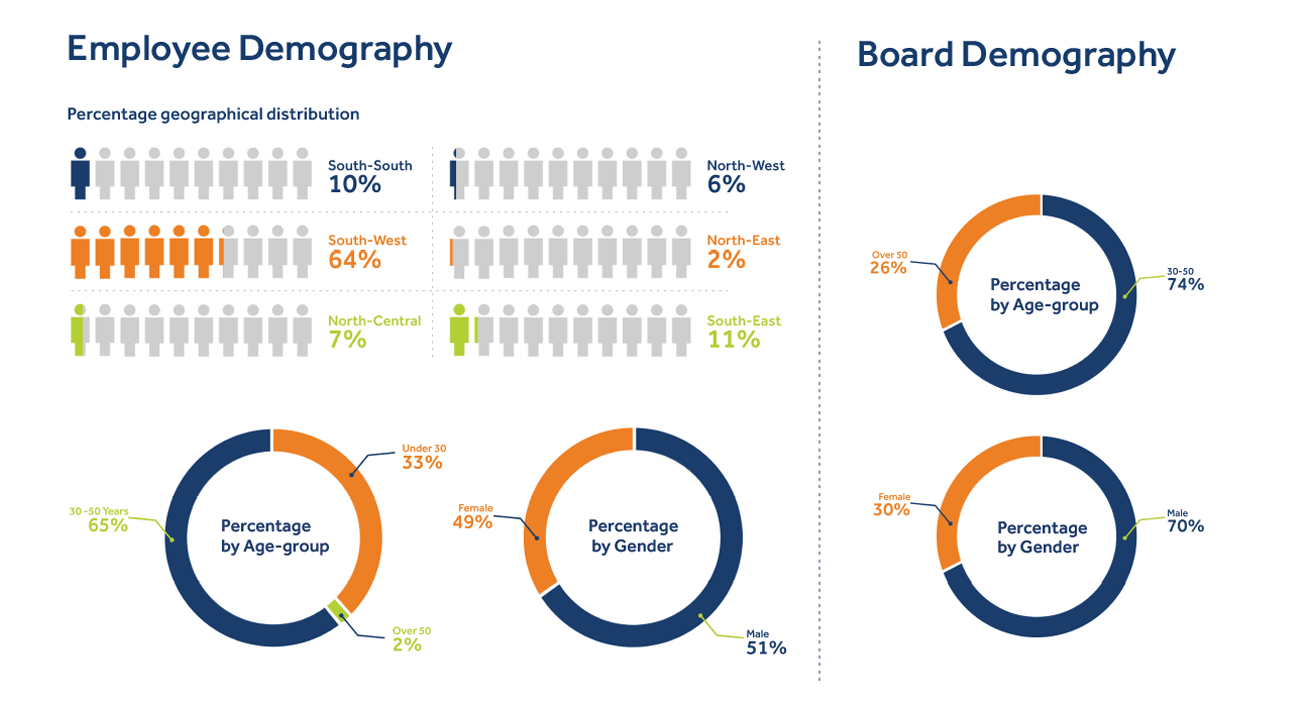

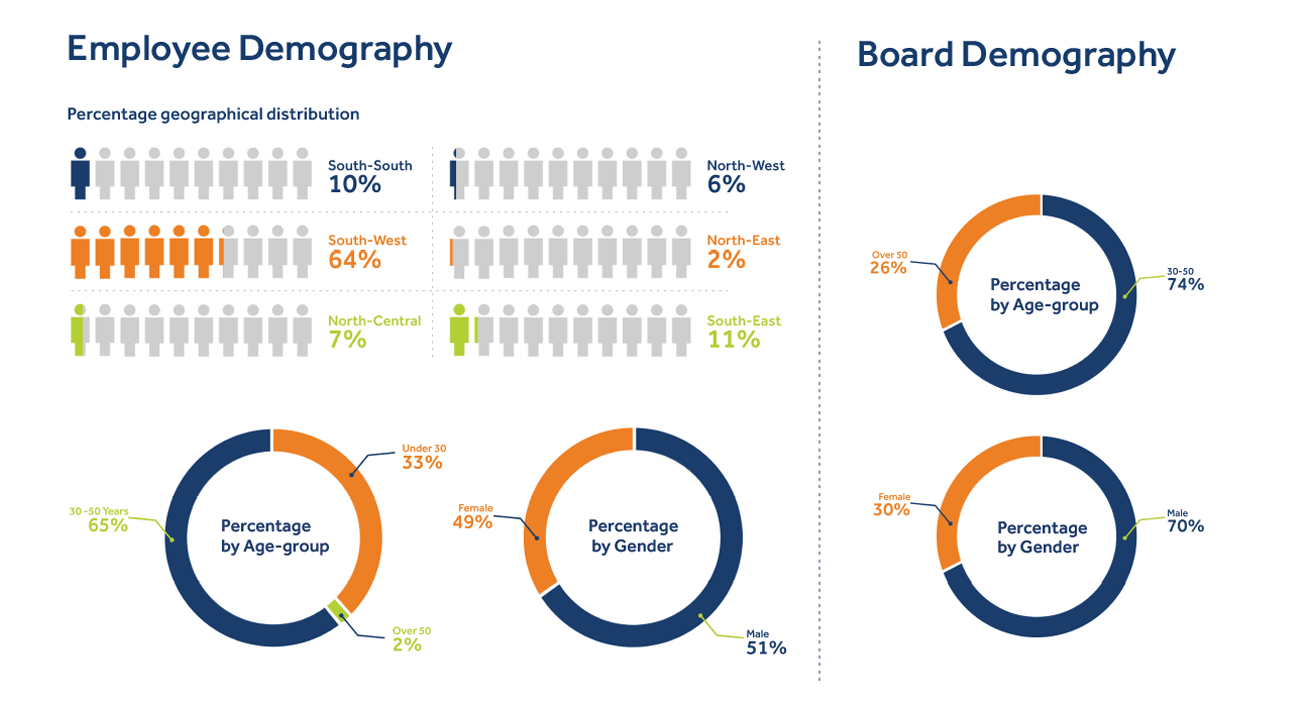

Access Bank’s Employees

Our employees are the engines that run our systems. Our workforce not only

share our belief of financing a sustainable world, they are ambassadors for

that mission. Our employees constantly bring the best of their knowledge and

expertise to the organization and we are proud of the work they do across our

organization.

In 2020, we engaged our employees through the “We CLAP: We Care, We

Lead, We Appreciate and We Perform” initiative. We provided learning opportunities

to help employees grow in their various fields. There were also workshops

and roadshows to increase employees’ understanding of the Bank’s

vision and culture. We celebrated employees’ volunteering activities and the

Bank’s numerous successes which we achieved through the work of our employees;

and importantly, we acknowledged special events in their lives.

The COVID-19 pandemic changed how we engaged with each other and

our ways of getting the job done. However, this global challenge did not only

strengthen our workforce, it opened up alternative, innovative and efficient

ways of communication, which going forward, will be embedded into our organizational

structures while achieving our objectives.

Together, all 15,611 of us form one strong body that continues to set the

pace in delivering exceptional service across our various offerings.

Our current employees filled 35% of open roles while

11% of employees assumed new roles in 2020. 81%

of new hires were at entry-level and were majorly fresh

graduates. The attrition rate was 13% of professional

staff. All employees earn the same amount by employee

category irrespective of gender. All employees,

whether full time or third-party employees of the bank,

undergo training and enjoy all benefits.

Our employees, through the Employee Volunteering

Scheme, contribute ideas, skills and resources to address

social, environmental and economic issues whilst

gaining hands-on experience and fulfilment as positive

role models in society. We have achieved 100%

employee participation in the Access Bank’s Employee

Volunteering initiative, empowering employees to

contribute to the sustainable development of communities.

Some of the most notable initiatives from the

Employee Volunteering Scheme in 2020 are discussed

under the Community Investment section.

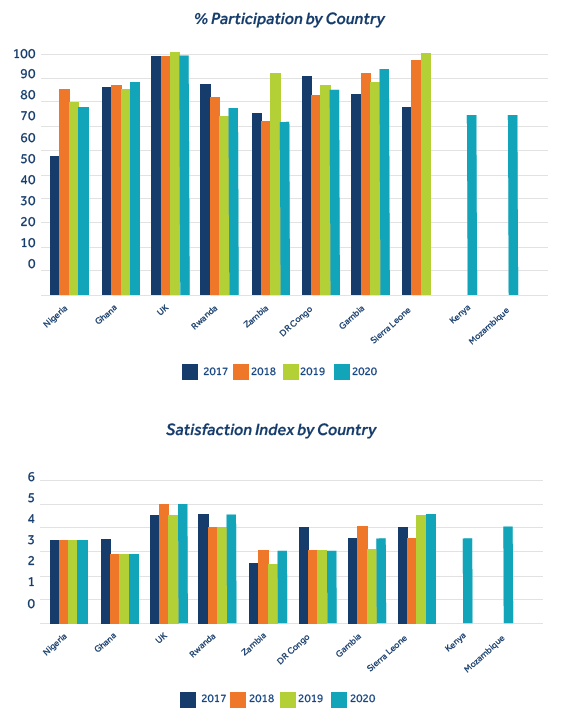

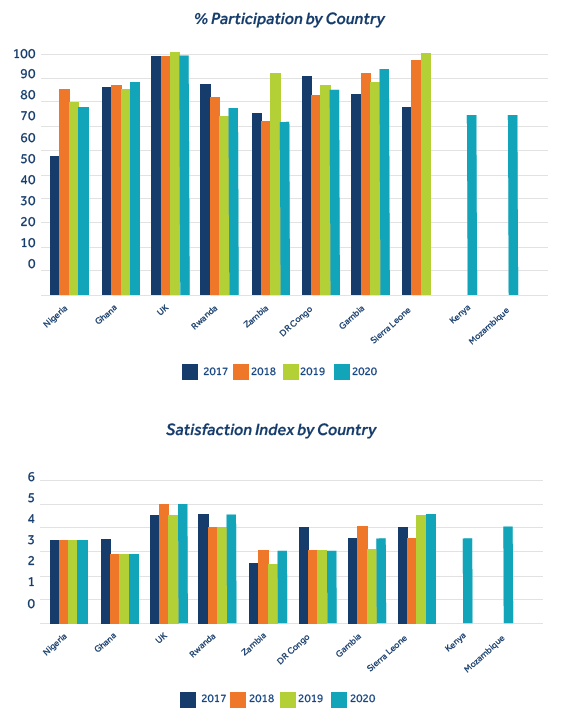

Employee Satisfaction

It is our annual practice to conduct an employee satisfaction

survey across our parent company and the

subsidiaries. This survey helps us measure the level

of employee commitment and engagement in 2020.

It also helps us obtain insight from an employee perspective.

The process is anonymous and is managed

by a third party, Ëngaged Metrics Inc. In 2020, there was

an average participation rate of 80%. This is a decrease

from last year’s (2019) rate of 84%. This is due to data

and network challenges since most respondents were

working from home.

The employee satisfaction index remained constant at

3.5, which is below the plan of 4.0. In percentage terms,

there was a slight increase from 71.5% to 73.1%. This

increase in satisfaction is attributable to employees

believing that their jobs contribute to the purpose of

the organization and that their development is encouraged

by someone in the organization. The employee

satisfaction index for the UK, Rwanda and

Gambia subsidiaries increased as employees were

more responsive to the various engagement initiatives.

The organization is bearing in mind that more

developmental programs need to be in place to enhance

employee productivity and fast-track the careers

of key talents.

Every year, Access Bank dedicates a week to fostering

sustainability among its employees. The 2020 edition

of the Sustainability Awareness Week held from December

14-18, 2020. The Week was themed ‘Sustainability

as Pathway to a Resilient Future’ and featured

‘edutaining’ events and activities to raise awareness for

employees and even the general public on sustainability

and sustainable practices.

The week consisted of a five-day online educational

session on a variety of topics, and daily sustainability

tips and quizzes. About 767 persons attended the online

training and webinars and 269 people participated

in the virtual Zumba class. As part of the activities to

commemorate the Week, the Bank organized a Sustainability

Chat, themed ‘Understanding Interactions

Between the Sustainable Development Goals,’ featuring

former Minister of Environment and Member of

Parliament of Denmark, Kristen Brosbol and was moderated

by the Project Director, HACEY Health Initiative,

Isaiah Owolabi.

The purpose of the session was aimed at helping to

establish a baseline understanding of important interactions

within the 2030 Agenda and its set of 17 Sustainable

Development Goals (SDGs), and to launch a

discussion on the implications of these interactions for

integrated approaches to implementation of the 2030

Agenda.

Occupational Health and Safety

The health and safety of our employees remain a top

priority for Access Bank. The wellbeing of our people

is the wellbeing of our business. The Health, Safety,

Security and Environment (HSSE) department of the

bank guides our approach and response to all matters

relating to health and safety, both for our employees

and other stakeholders. Through this department, the

health and safety impacts of our products, services and

operations are assessed. In 2020, our Health and Safety

training focused on Fire Safety Management and

Evacuation for the Health Champions and Fire Marshals

in the bank.

Access Bank recognized the COVID-19 pandemic for

the health risk that it was and took vital steps in response

to it. At the onset of the pandemic, even before

the government declared the nationwide lockdown,

our Business Continuity Plan was initiated. Most

branches were closed and most members of staff

worked from home to minimize the risk of exposure.

Contact centres were opened across communities

and most transactions became automated. When the

lockdown was lifted and businesses were allowed to

operate, strict adherence to the COVID-19 protocols

established by the Nigeria Centre for Disease Control

was ensured across all open service outlets. The bank

in partnership with CACOVID concluded arrangements

to vaccinate all staff.

Training and Development

Our employees undergo continuous training and

development programs, which they are fully interested

in. We invest in building up employees’

professional skills and aid their career growth.

We invested over N570.112 million in employee

training and development in 2020. The total

number of hours of training was 624,877,230

(Female employees – 287,443.42 hours; Male

employees – 337,433.58 hours), with the average

hours of training per employee being 40.77

hours. The training covered the following topics:

Leadership; Soft Skills; Risk Management; Digital

and Analytics skills; Health, Safety and Environment;

Sustainability; and functional programs.

This training is available to third-party employees

but not to third party organizations.

All employees receive regular performance review

and career review in 2020. This review is

carried out twice a year. Our employee exchange

programme across our subsidiaries also helps our employees

to learn about different aspects of the organization

and have the opportunity to develop skills and

knowledge across diverse cultures.

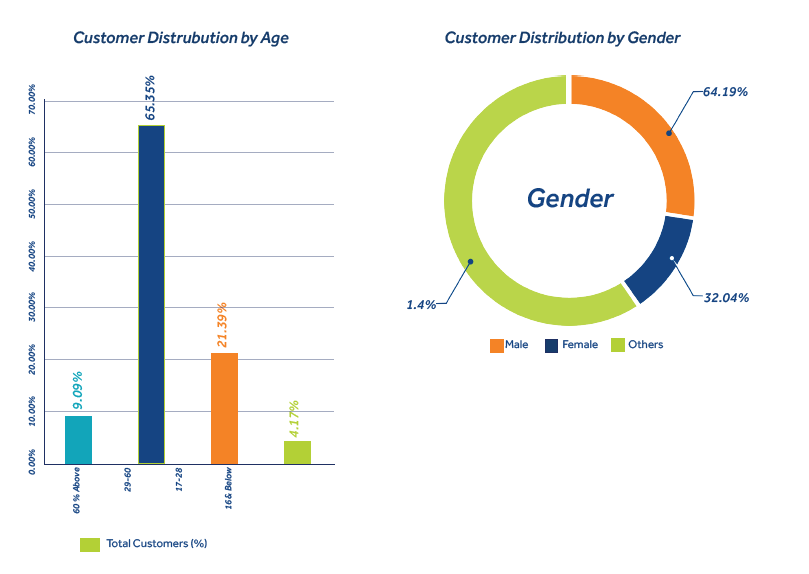

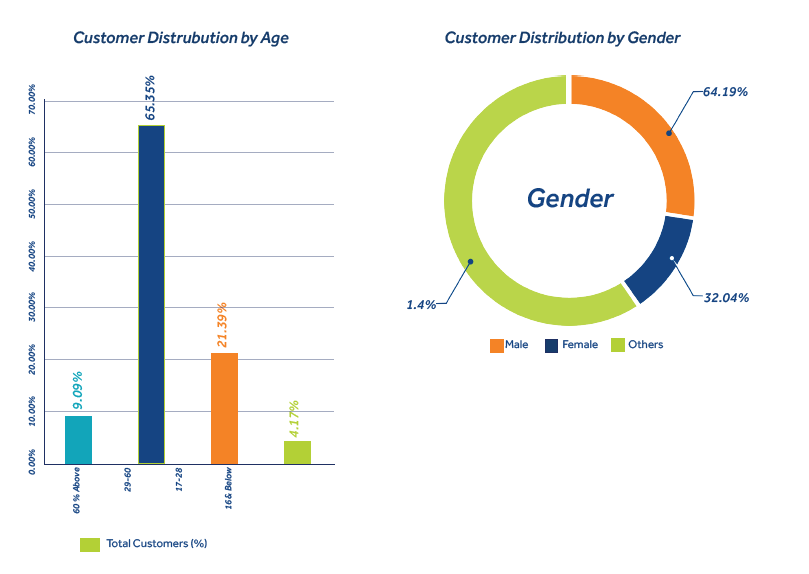

Our Customers

Our customers are the reason why our business exists,

and are important to its continued success. We

maintain our customers’ loyalty by focusing on offering

financial products and services that are important

to their growth and livelihood. Across our financial services,

we provide the most reliable and specific solution

to our various customers. We monitor and refine our

customers’ relationship, having a high regard for their

opinion. By working on the feedback we received on

our services, we have gained the trust of our customers

and this has earned us a 20% increase in the past

year.

Through our Customer Loyalty Reward Program, we

provided customers with an opportunity to earn points

from their everyday transaction, which can be used to

purchase household items and movie tickets among

others. We also deliver life-changing experiences for

customers through the “Diamond Xtra” and “Xclusive-

Plus lifestyle” propositions. We give end-of-year gifts

and celebrate our customers on their special days and

on holidays.

Total number of customers: 40.342 million.

Total value of customers’ deposits: N5.8 trillion.

Customer Safety and Data Privacy

The safety of our customers is always top priority

for us at Access Bank. We have measures

in place to ensure the physical safety of all our

customers. Customers that are pregnant, sickly

or above 60 years are attended to promptly. Our

buildings are also designed to facilitate easy access

for physically-challenged customers; there

are designated parking spaces and wheelchair

ramps for customers with disabilities. Necessary

safety measures are considered during the design

of all the bank’s buildings and facilities. We

have first aid boxes on all floors and have signed

on to an hospital ambulance service in some locations

to enable us quick access to medical

help during any emergency.

The safety of customer financial data is very

crucial to the existence of our business. We

continuously improve our security and validation

channels to protect customers’ deposits. More

financial information advocacy was provided to

customers during the pandemic as cyber fraud

became on the rise. Our Access More was enhanced

to block accounts immediately fraud is

suspected in thems. We also protect our customers’

deposits through the following measures:

-

Authentication/authorization of customer before

being able to carry out any activity on customer

accounts.

- Mandate/Signature requirement to identify customer

- BVN verification as required

- Passwords/PIN/Token for Channels Usage

-

Channels available to block account in the

event of fraud/fraud attempt/exposure.

-

Fraud Escalation available 24/7 via various

channels.

-

Audit/periodic review of activities on old and

new accounts.

-

Customers are alerted regarding activities on

their accounts; log in via online channels, deposits,

withdrawals, information update etc.

-

Unrestricted access to authorized persons to

relevant account:

- Provision of account statement to customers

- Realtime Access

-

Policy on privacy and breach of customer information.

-

Restricted access to dormant accounts.

-

Deposit insurance.

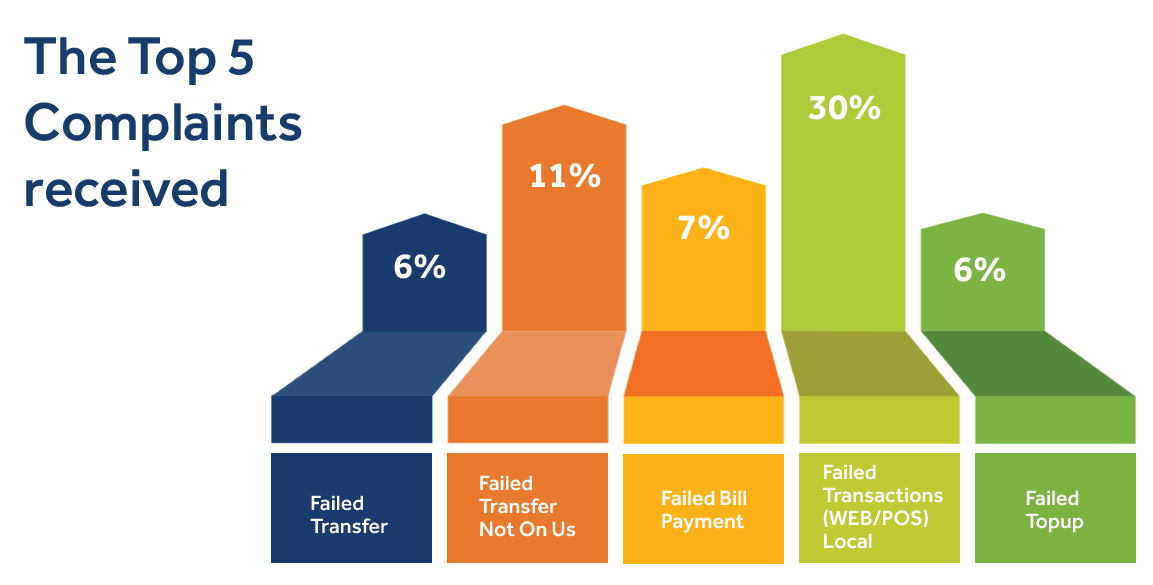

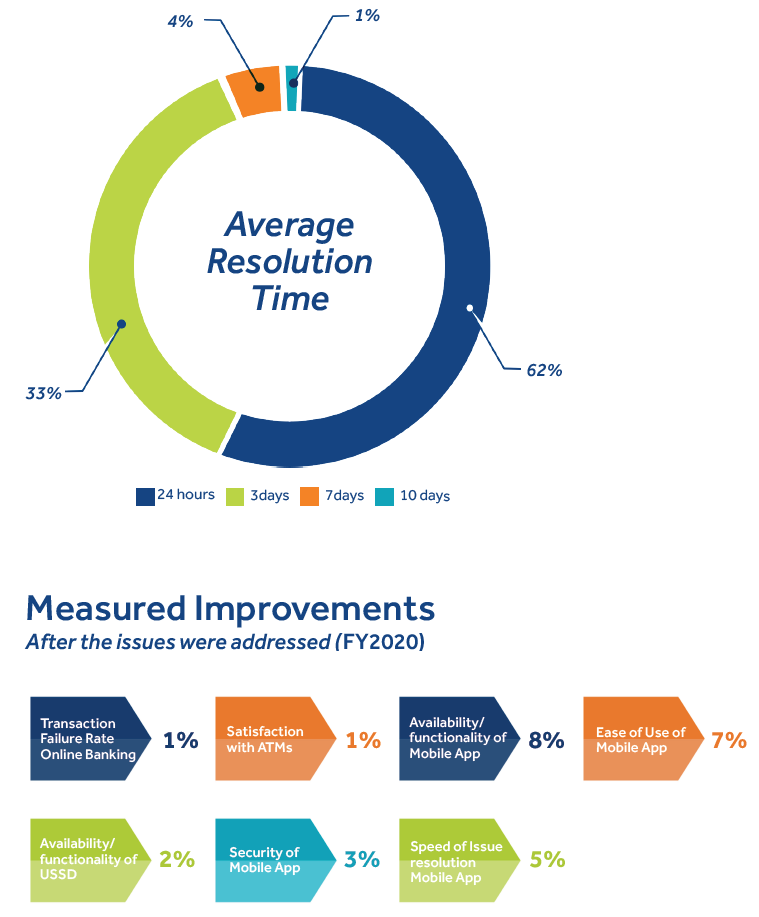

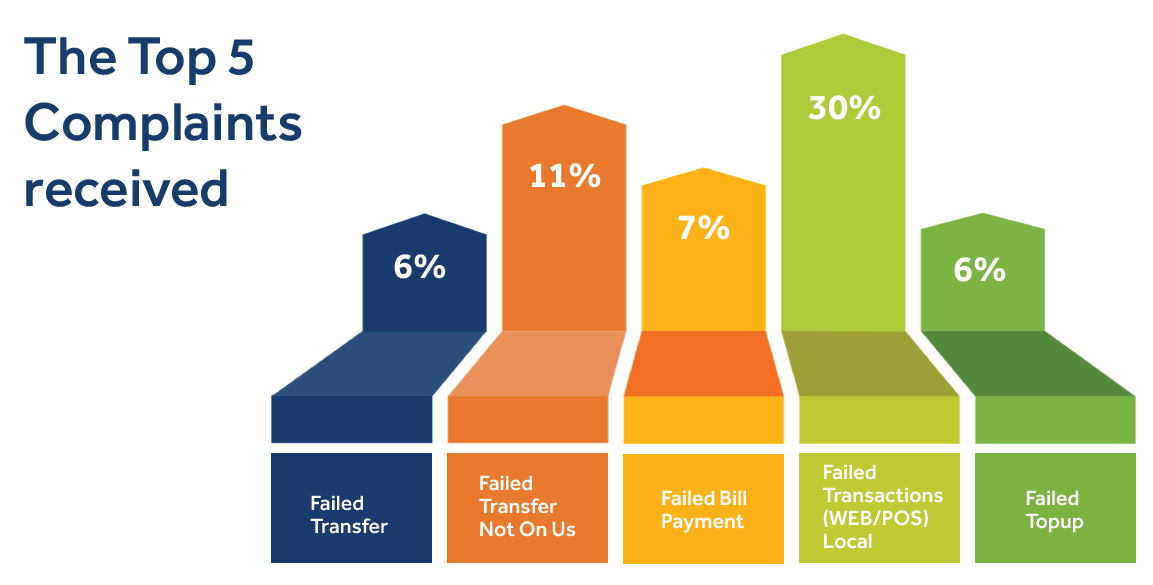

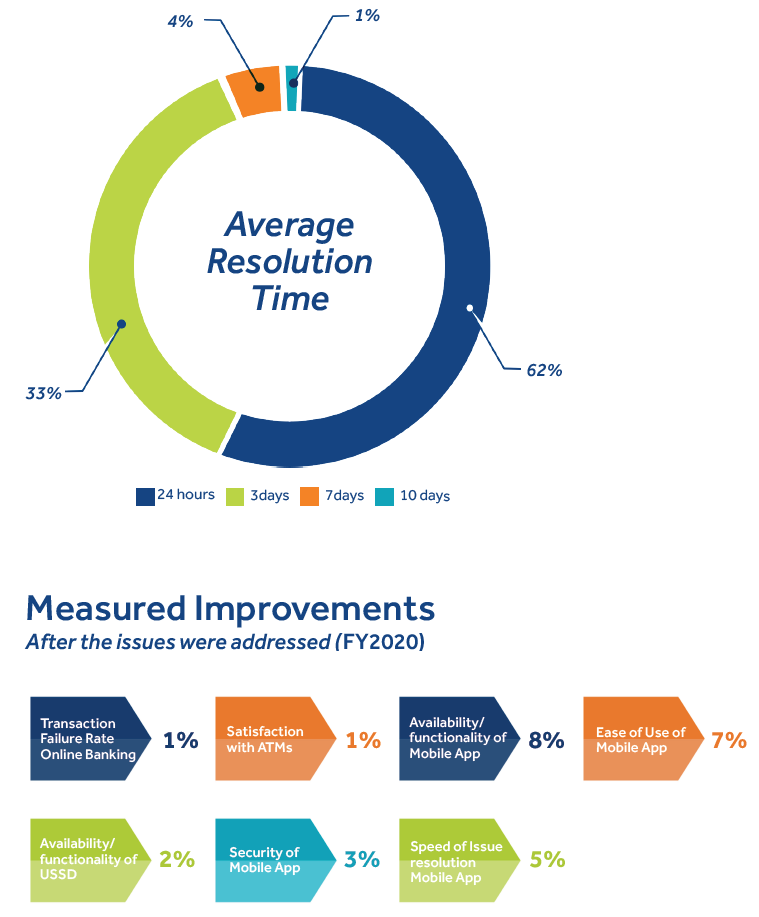

Issue Resolution

Access Bank has established platforms and processes for handling customer

complaints to drive customer loyalty, satisfaction, and quality assurance. This follows

from the fact that Access Bank understands that it is not immune to complaints

given that some customers may have challenges with the Bank’s products

and services.

A Customer Relationship Management (CRM) solution was implemented to facilitate

the systematic and orderly management of complaints. The platform allows

customers to make their complaints via various channels and track the resolution

of issues within defined timelines. We have put in place more resources

(human and digital) to help us respond to complaints as fast as possible. In 2020,

we resolved four times more resolutions that we did in 2019. Our resolution time

of one day increased from 15% to 62%.

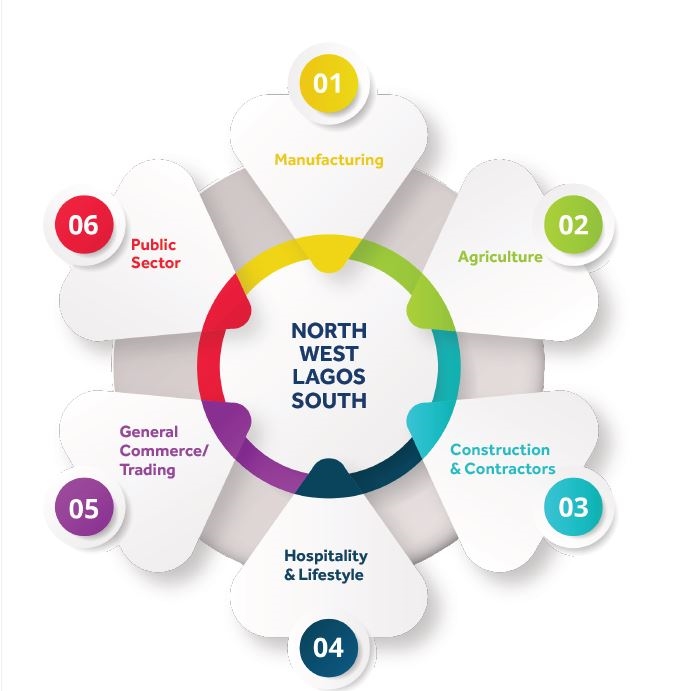

Financial Inclusion

Through our “Access Closa Agent,” we spread the borders of our operations to

the underbanked or unbanked. We branded over 10,000 agent locations across

the country, and in partnership with Google, our “Access Closa Agents” are easily

located by searching on Google Maps. This improved our visibility and expanded

our reach.

The Closa Agent Network has created thousands of jobs both directly and indirectly

across the entire agency banking ecosystem in Nigeria and also greatly improved

the income levels of thousands of local businesses who have partnered

with Access Bank to drive our financial inclusion strategy. Our agents have become

brand ambassadors for the Access Bank brand. The growth and wide acceptance

of our agent network were characterised by the surge in daily transaction

values from N2 million in January 2020 to N5 billion by the end of December

2020, with over 1,600% in revenue growth as revenues moved from N43 million in

January to over N700 million by December 2020.

Access Bank has continued to support the growth, development and prosperity

of the communities and societies where its operations are carried out. We understand

the importance of investing in the development of our communities. Our

community initiatives are aimed at providing support and equipping numerous individuals

to lead healthier and more productive lives. In return, this has helped expand

our market share, built goodwill for our brand, and given us additional motivation

to do more.

Check out our Community Investment Intiatives here.

We support various initiatives, projects, organizations and events that are focused

on impacting the communities that we live and operate in positively. These investment

initiatives are centred on our commitment to empower local communities

and strengthen existing relationships with our partner organizations.

As such, we have invested over N10.25 billion in various corporate social responsibility

efforts since 2015, which has impacted 1,316 communities and reached

30,075,356 lives and 793 NGOs. These projects have been in our CSR priority areas

which are Health, Education, Sport, Arts, Environment, Women Empowerment,

and Social Welfare.

Some of our notable commun ity investment programs in year 2020 are as

follows.

HEALTH

Access Bank Lagos City Marathon 2020 and Free HIV/AIDS Testing

In partnership with the Lagos State Government, Access Bank hosted the 2020

edition of the Access Bank Lagos City Marathon. This event promotes healthy

living by maintaining physical fitness through exercise. The partnership also

involves providing strategic support to the State Government in the area of

sports. The marathon has drawn both local and international attention as the

event has been approved by the Athletics Federation of Nigeria and endorsed

by the International Association of Athletics. The marathon also drew athletes

from across the globe with over 100,000 athletes participating in the annual

event.

This edition of the marathon was themed “More Than A Race” and it held on

February 8th, 2020. David Barmasai Tumo, Debeko Dakamo and Paul Waweru

Chege came first, second and third, respectively, with finishing times of

2h:10m:23s, 2h:10m:55s and 2h:11m:23s, respectively, thereby breaking the

records set in 2018 by Abraham Kiprotich. The female category had Cherop

Sharon Jemutai, Kebene Chala Urisa and Rodah Jepkorir Tanui taking the

first, second and third positions, respectively, with Cherop finishing the race in

2h:31m:40s. The winners in both the male and female categories of the 42km

race went home with $50,000, $40,000 and $30,000 for the first, second and

third positions, respectively.

In addition to hosting the 2020 Lagos City Marathon, Access Bank leveraged

the marathon platform to create awareness around HIV prevention, by providing

counselling and testing exercises for athletes at the marathon. Access Bank

partnered with the Nigerian Business Coalition Against HIV/AIDS (NiBUCCA) to

provide HIV testing and counselling services during the marathon kit collection

period at Teslim Balogun Stadium and on the race day at Eko Atlantic City. HACEY

Health Initiative, a non-governmental organization that is focused on implementing

health programmes across Nigeria, also supported the efforts.

Counselling and testing were carried out by experienced and trained counsellors

and testers, using standard procedures and kits, and maintaining result confidentiality.

Positive HIV cases were referred to health facilities for management. A total

of 3,235 people were counselled and tested, with 11 HIV reactive cases discovered,

which have since conducted further tests and commenced treatment.

Also, 10,000 condoms were distributed.

A total of 249 new cases of mother-to-child transmission of HIV were prevented

as a result of the awareness programme of the campaign. A video documentary

on key activities of the testing programme was produced for advocacy and promotion

after the programme. The HIV video documentary on the screening had

over 10,000 views as of mid-2020.

Access Bank also partnered with The END Fund, a private philanthropic initiative

solely dedicated to ending the five most common neglected tropical diseases

(NTDs), at the 2020 Lagos City Marathon to raise awareness on the NTDs. Over

2,118 participants at the marathon were also educated directly on parasitic infections,

including River Blindness, Lymphatic Filariasis (Elephantiasis), Trachoma, Intestinal

worms and Schistosomiasis (Snail Fever).

World Kidney Day Program

Kidney disease is a non-communicable disease and currently affects around

850 million people worldwide. The global burden of kidney disease is increasing

and is projected to become the 5th most common cause of years of life lost

globally by 2040, as one in 10 adults has chronic kidney disease. World Kidney

Day continues to raise awareness of the increasing burden of kidney diseases

worldwide, and to strive for kidney health for everyone, everywhere.

The Theme of 2020 World Kidney Day was “Kidney Health for Everyone Everywhere.”

The aim was to highlight the importance of preventive interventions to

avert the onset and progression of kidney disease.

The World Kidney Day was commemorated by Access Bank in partnership with

Kidney Foundation for Africa (KFA). The Bank hosted the “Chronic Kidney Disease:

Stop the Epidemic in Africa” program on March 12, 2020, at the Eko Hotel

& Suites and a Kidney walk on March 13, 2020. Key stakeholders including

The First Lady of Lagos State, Ibironke Sanwo-Olu; Chairman, Access Bank Plc,

Ajoritsedere Awosika; Professor Mohammed M. Nars Allah, Professor & Consultant

of Internal Medicine & Nephrology, Cairo University (North Africa); Dr. Esther

Getambu, Consultant Physician/Nephrologist (East Africa); Professor Alain

G. Assounga, Head, Nephrology Unit, Nelson Mandela Medical School (South

Africa), and Dr. Ebun Bamgboye, Consultant Physician/Nephrologist (West Africa),

were all present at the program.

The conference and the walk were aimed at raising conversations in Nigeria and

encouraging early prevention of the disease. Information on screening of all patients

with diabetes and hypertension to detect kidney disease was advised for

all medical professionals and health facilities in Nigeria. 180 participants were educated

with information on kidney disease prevention and treatment measures.

Over 195 people participated in the Kidney walk to raise awareness on the importance

of the kidney to the body and reduction of its associated problem worldwide.

The Lagos State ably represented by the First Lady, Ibironke Sanwo-Olu, committed

to intensifying awareness among Lagos residents on the devastating effect

of kidney disease. The conference also catalyzed the acceleration of kidney disease

prevention, treatment and awareness under the THEMES Agenda (a policy

thrust for Traffic Management and Transportation, Health and Environment, Education

and Technology, Making Lagos a 21st Century Economy, Entertainment

and Tourism, and Security and Governance) of the Lagos State Government.

Project Agbebi – Maternal and Child Health Program

Project Agbebi was created as a response to the high incidence of maternal and

child mortalities in South-East Nigeria. High maternal mortality rates and newborn

deaths have remained a major public health concern in Nigeria. The country

accounts for 20% of global maternal deaths with a maternal mortality ratio

of 8 deaths per 1,000 live births, which happens to be one of the highest in the

world.

Access Bank partnered with HACEY Health Initiative to implement the maternal

and child health programme in Ebonyi State. The programme consisted of

capacity building sessions for healthcare providers and birth attendants, stakeholder

engagement and distribution of sterilized birthing kits.

Primary health care providers and birth attendants were trained to provide better

service delivery, practice proper hygiene, prevent infection during pregnancy

and delivery, and carry out follow-ups for pregnant women and newborns. Information,

communication and education tools such as videos, radio messages,

fliers and posters were created to disseminate life-saving information for

safeguarding the lives of pregnant women. Birthing kits were distributed to the

participants and pick-up points for the birthing kits were established within the

communities to guarantee access for women and healthcare providers.

Lastly, there were dialogue sessions between primary healthcare providers and

community birth attendants to ease the referral process between them. The

community leaders and other members were also engaged and enlightened.

Malaria Awareness Program

As the burden of malaria continues to plague the Nigerian nation, with a high

prevalence in children under age five, Access Bank continues to lend its support

to communities and to the nation at large to end malaria in Nigeria. To commemorate

the 2020 World Malaria Day, Access Bank partnered with the Corporate Alliance

on Malaria in Africa to deliver malaria prevention, control and treatment program

amidst COVID-19 in five communities across Oyo, Lagos and Ogun states,

namely Ogo-Oluwa, Eredo, and Iberekodo in Lagos State; Aremo and Oke-Ado in

Oyo State; and Ibafo in Ogun State.

Long-lasting insecticide-treated nets (LLINs) were distributed to members of

these communities. They were also provided information, communication and

education materials. This initiative had over 200,000 IEC beneficiaries and 1,600

LLINS were distributed.

Nigeria has a high burden of tuberculosis and is ranked seventh among the 30

high TB burden in the world and second in Africa. To reduce the prevalence of tuberculosis

and eradicate the stigmatization and ignorance associated with tuberculosis,

Access Bank in partnership with Nirvana Initiative implemented a TB program

in Local Government Areas (LGAs) across Anambra State. In Muru Village,

200 people were sensitized to TB prevention and 100 sputum cups were distributed.

Community.

In Awada, Idemili North LGA, tuberculosis information and education sensitization

which reached a population of 10,320 residents (860 children and covereing

14 settlements/zones) was carried out. Thirty-three persons sensitized to TB,

seven sputum cups shared, seven sputum sample collected and one person sent

for a chest X-ray in a primary healthcare centre in Awada. Twenty-three women

of childbearing age were educated on TB, 10 sputum cup shared, one person

sent for chest X-ray at Basic PHC, Court Road.

TB education town announcement, sensitization and market outreach were conducted

at Ogbeumonicha, Onitsha North LGA (covering seven settlements, with

a total population of 41,852). Media awareness on TB prevention, control and

treatment was done at Anambra Broadcasting Service (ABS) Awka, and 52,728

people were reached.

World AIDS Day

Access Bank sits on the Board as co-Chair of the Nigerian Business Coalition

Against AIDS (NiBUCAA). NiBUCAA is the voice of the private sector response to

HIV/AIDS in Nigeria. The organization was set up to position the private sector in

capitalizing on their unique strengths and proficiencies in HIV program areas and

mitigate the impact of viral infection in the workplace and society in general. The

Bank partnered with NiBUCAA to commemorate World AIDS Day across several

communities in Nigeria.

Messages on HIV prevention, HIV counselling, testing and referrals were provided

to communities in Lagos State (Badiya, Epe, Ijora, Ikorodu), Ondo State (Ondo

town), and in the Federal Capital Territory (Mabushi community). 20,000 information,

education and communication materials on HIV and 15,000 condoms were

distributed across these communities. 3,164 people were tested for HIV and

there were 44 HIV positive cases.

EDUCATION

Scholarship for Special Needs Students

Access Bank promotes inclusive, equitable, quality education and promotes

lifelong learning opportunities for all. Access Bank partnered with the Centre

for Youth Studies to award scholarships to special needs students of King’s and

Queen’s College undergoing the CYS Life Skills training program. The Centre

for Youth Studies (CYS) is a non-governmental organization that employs creative

media to disseminate information. The organization primarily uses drama,

in print, audio and audio-visual media to disseminate empirically verifiable

information on the lifestyles and patterns of behaviour among young people in

Nigeria. The Life Skills training program includes character development classes

and re-orientation training, communication improvement classes and overcoming

inferiority complex training for special needs students.

Soil Conservation Education for Sustainable Farming

The rising impact of climate change on food security makes farmers to struggle

with new environmental challenges. This creates a need to promote awareness

of sustainability in agriculture and farming practices to ensure food security. To

achieve this, Access Bank partnered with Glow Initiative to implement the Soil

Conservation Education Program for Sustainable Farming (SCEP-SF). Glow Initiative

is a non-governmental organization focused on environmental and economic

empowerment programs.

The program, which took place in Enugu State, featured an environmental sustainability

awareness tour, a “Young Farmers Connect”, which is an environmental

sustainability in farming training program and a tree planting for sustainability

exercise, to commemorate the World Day for Soil Conservation. Soil Conservation

information, education and communication materials were distributed to

over 800 students, farmers and farmers’ associations.

Digital Learning Content for Mass Literacy Programs

Access Bank partnered with CARE Initiative to birth the project tagged “Development

of Digital Learning Contents for Mass Literacy Programs in Ogun State.”

CARE (Childhood Advancement Response and Empowerment) Initiative is a

non-governmental organization working to promote and protect the rights and

welfare of every child including street children. The project is in response to the

need to introduce digital teaching and learning into mass literacy programs in Nigeria.

There was a train-the-trainer session on digital skills for literacy educators. Participants

were drawn from literacy centres operated by government agencies,

community associations, faith-based organizations and non-governmental organizations.

There was also a stakeholder engagement with the Ogun State

Agency for Mass Education on the adoption of digital learning tools into the

school curriculum.

Education Without Abuse (EWA) Program

Access Bank, again, partnered with CARE Initiative to birth the Education Without

Abuse (EWA) program. The program focused on putting in place a stronger

structure for keeping children safe in schools. 600 participants had increased

knowledge of child rights, personal responsibilities, and the role of teachers as

duty bearers in upholding the rights of every child in schools. Thirty participating

schools committed to instituting “Child Rights Protection.”

ENTREPRENEURSHIP

Green Social Entrepreneurship Program

Access Bank continues to drive social change, especially through women and

youth. The Bank partnered with SME Funds to develop the Green Social Entrepreneurship

Program (GSEP), intending to empower women and youth to become

‘Social Entrepreneurs’ whilst driving the use of innovative green cooking

technology in Lagos and Ogun states. Towards achieving this goal, a capacity

building program on Digital Marketing, Lead Generation and Sales for social entrepreneurs

was held. Green hubs were also created as well as tactics for making

the delivery of the energy finance program better.

The program focused on empowering entrepreneurs with clean cooking stove

technology aimed at replacing existing cooking technologies that are harmful

to health and the environment. The Clean Stove technology makes it economically

feasible to convert waste-based biomass to biofuel. The technology

makes use of bio gels. The bio gels are made from water hyacinth, biocremol,

custic soda, fragrance, and chlorophyll. The Green Social Entrepreneurship program

aligns with the following Sustainable Development Goals: SDGs 1, 2, 5, 7

and 13.

Specifically, 238 social entrepreneurs were empowered with funds and have

commenced their clean stove technology business. 2,100 people have been

reached with the use of clean stove technology. 7,500 litres of bio-gel produced

and distributed. 598 households now make use of the clean stove technologies

across Nigeria. 287 metric tonnes of CO2 emission was prevented as a result of

the use of the clean stove technology.

Agribusiness Livelihood Improvement Program

Access Bank partnered with Xploit Consult to implement agribusiness livelihoods

improvement programs. This program was to strengthen food security in benefitting

communities and alleviate poverty. Xploits Consulting Limited (XCL) is

an Environmental and Social management organization focused on sustainable

projects that enhance the socio-economic state of individuals but also benefit

the environment in the interim and long-term. Under the program, 56 people in

communities in Kogi and Nassarawa states were trained on snail rearing and fish

farming, while 224 community people were impacted with agribusiness skills.

EMPOWERMENT

World Wild Life Champions

Local communities have habitats that are home to important wildlife species.

However, the people of the communities may not know this and proceed to kill

wildlife once sighted. To build knowledge, positive attitude and practices towards

wildlife conservation amongst local community dwellers, and also to institute

conservation clubs in schools to sensitize youths and advocate actions

for effective wildlife conservation, Access Bank partnered with Glow Initiative

for Economic Empowerment to implement the Save Wild Life program in Enugu

State.

The program was held across four communities in Enugu State, which include

Orieani Amechi, Udeji Amechi, Enugu Ngwo and Garriki Awkunanaw. A Save

Wild Life in Enugu policy brief was developed and presented to government

stakeholders: Commissioner for Agriculture and National Resources, Enugu

State. 250 hunters and farmers were educated on “Making Conservation a

Habit’’ at Ngwo Community. 280 community secondary school students were

educated on “Save Wild Life’’ in Enugu and Conservation clubs were instituted

in schools across four communities. There was also a strategic discussion

held with the Ministry of Environment to promote a wildlife protection law. Over

2,000 people were impacted by the Save Wildlife Program.

#FollowDisACT Campaign

The International Day of Persons Living with Disabilities (PLWDs) is observed to

promote the full and equal participation of persons with disabilities to take action

for the inclusion of PWDs in all aspect of development. Access Bank partnered

with Project Enable to commemorate the 2020 PLWD Day, themed “Building

Back Better: Towards a disability-inclusive, accessible and sustainable post-

COVID-19 world.”

The program was to showcase the ideas, businesses and productivity of the disability

community in Nigeria towards amplifying their voices and strengthening

the institutional capacity of the community. Part of the event was a business

pitch competition for PLWDS to showcase and support the business ideas of

young entrepreneurs; the launch of Business Support Program faculty chaired by

Head Sustainability, Access Bank, Omobolanle Victor-Laniyan and the General

Manager of the Lagos States Office for Disability Affairs, Mr. Dare Dairo; and the

unveiling of most inspiring persons with disabilities list and documentary series as

part of the #FollowDisACT Campaign.

Covid-19 Response

The COVID-19 pandemic affected the health, economic

and social wellbeing of the world with communities

in developing nations and vulnerable groups

taking the worst hit. To show our commitment to society,

especially in communities where we carry out

our operations, we supported vulnerable and underserved

groups to help alleviate the impacts of the

pandemic.

In Nigeria and across the world, governments are

implementing strategic measures to reduce and

mitigate the risk and spread of COVID-19, one of

which is the stay-at-home practice, which resulted

in the closure of schools, offices and trading centres

amongst others.

Succour For People Living With Sickle Cell

In partnership with Temitayo Help Foundation and

Nirvana Initiative, both non-governmental organizations,

Access Bank reached out to people living with

Sickle Cell Anaemia and vulnerable families in the society

amid the COVID-19 pandemic. Food items and

relief materials were distributed to people living with

sickle cell disease. There were also sensitization sessions

on COVID-19 prevention, maintaining good

health, and physical and mental wellbeing, amidst the

pandemic. In total, 2,000 people, inclusive of vulnerable

families, were reached with COVID-19 food palliatives.

The 2020 World Health Day (WHD) was focused on

celebrating healthcare workers especially nurses and

midwives across the globe for the precarious role

they play in ensuring the safety of newborns and the

world at large. Around the world, people spent the

day thanking the nurses and healthcare workers on

the frontlines battling the COVID-19 pandemic.

At Access Bank, in recognition of the contributions

of community birth attendants and healthcare providers

in semi-urban and rural communities towards

managing the coronavirus pandemic, we partnered

with HACEY Health Initiative, an NGO focused on

maternal and child health as well as other health-related

programs, to commemorate the 2020 WHD

across four communities in Lagos and Ogun States.

5,000 information, education and communication

(IEC) materials were distributed to community birth

attendants, pregnant women, and women with under-

5 children. The initiative had 500 beneficiaries of

hygiene materials and 500 beneficiaries of food palliatives.

Persons Living with Disabilities (PLWDs)

Persons living with disabilities are a major vulnerable

group adversely affected by the COVID-19 pandemic.

These individuals generally require more healthcare

than other people and will be greatly affected

by the socioeconomic impacts of the pandemic. Access

Bank, to reduce the economic burden of the

COVID-19 outbreak on PLWDs, partnered with Estrategico,

an organization focused on creating means of

livelihood for vulnerable groups, to deliver a COVID-19

Campaign program for PLWDs. Food palliatives, hygiene

products and IEC materials were distributed

among the PLWDs community.

Relief Program for Correctional Centers

Access Bank partnered with the Centre For Youth

Studies (CYS) and Nigeria Association of Social Workers,

Lagos Chapter to deliver a COVID-19 program

geared towards the development and sustenance

of young boys and girls in correctional centres in Lagos.

The program was held at the Special Correctional

Centre for Boys, Oregun, Lagos and Special Correctional

Centre for Girls, Idi-Araba, Lagos. A life skills

training program was designed to equip the young

boys and girls with skills that build character and to

help them maintain healthy mental wellbeing.

Food palliatives, exercise books and CYS life skills

books were distributed to 196 beneficiaries in the

Special Correctional Centre for Boys and 70 beneficiaries

for the Special Correctional Centre for Girls. Boys

and girls were sensitized on the subjects ‘Love Your

Self’ and on the ‘Role of a Social Worker’ in the rehabilitation

of students in the correctional facilities.

Street Children and Children In Orphanages

Access Bank partnered with Care Initiative to birth

the “School in the Street” COVID-19 response program.

The program was implemented across Lagos

and Ogun states and was to provide additional support

for street children and children in orphanages to

keep them safe amidst the coronavirus pandemic. For

two weeks, one meal a day and hygiene materials were

provided for 700 street children. Raw food items and

hygiene materials were also provided for 300 children

in orphanages.

Relief Program For Elderly And Widows

Amidst the COVID-19 pandemic, Access Bank partnered

with PDI to organize a relief drive for elderly

people and vulnerable widows. Raw food items, hygiene

products and IEC materials were distributed to

500 widows and elderlies to help improve their living

and mental conditions.

Response For Rural Women

Access Bank partnered with Glow Initiative to organize

the Rural Women Coronavirus Awareness Initiative.

The initiative focused on raising awareness

on coronavirus amongst rural women in Awkunanaw

rural village, Enugu State. COVID-19 ICE materials in

the Igbo language were distributed to 500 women.

Relief food palliative and face masks were distributed

to 100 women.

Access Bank in collaboration with Xploit Consult implemented

programs aimed at driving positive

change in the lives of vulnerable groups, which include

widows, orphans, internally displaced persons (IDPs),

elderlies and People Living With Disabilities, amidst

COVID-19 lockdown restrictions in communities across

Abuja.

The program was implemented across five communities

which include Dawaki, Dutse Alhaji, Dutse Makaranta,

Dutse Bakuma, and Byazhin. 500 packs of food palliatives

were distributed across five communities in Abuja

(100 food packs each for widows, orphans, IDPs, elderlies

and the disabled in each of the five communities)

and 1,000 face masks were also distributed in the communities.

Access-9ija Kids

The stay-at-home order by various governments

across the world including Nigeria was a strategic

measure to reduce the spread of the coronavirus.

However, this meant the closure of schools, offices

and other commercial centres. School closure left

children at home with few educational activities to do.

To keep children at home engaged and educated, Access

Bank partnered with 9iJa Kids to deliver online financial

literacy and educational gamification modules

to children.

The program delivered six gamified educational learning

modules which were hosted on the Access Bank

website over aperiod of 12 weeks. The modules included

“Kiddiepreneur 101”, “Solve that Problem”,

“Who wants to be a Brainiac”, “Nigerian Facts”, “Timmy

in Charge” and “9ija Citizenship Test”. The top five

players on the leaderboard stood a chance to win exciting

prizes and the winners were announced three

times a week on the Bank’s social media platforms.

Prizes were redeemed through the Access Bank Early

Savers account, further encouraging an early savings

culture among children.

The program engaged over 1,700 children, and more

than 150 children won prizes via the Access Bank Early

Savers account. These children were also recognized

on the Access Bank social media platform.

The program impacted over 100,000 Nigerian children

and parents with financial literacy education and

had become a worthy example to emulate by other

organizations in Nigeria.

Family Clean Cooking Program for Underprivileged Households

Access Bank partnered with SME Funds, a social enterprise

focused on ending poverty through the

promotion of sustainable enterprise development,

to develop the Family Clean Cooking Support Program

for underprivileged households across Nigeria

amidst the COVID-19 pandemic. Over 2,000 families

were reached across Nigeria with clean stoves and

bio-gels. 225,000 minutes of productive time, 625

gallons of water and 30 days savings of N1,300/ $3

was saved for families.

Act Foundation Grantee Program

Access Bank has been in partnership with the Aspire

Coronation Trust (ACT) Foundation to accelerate

impact in the focus areas of environment,

health, entrepreneurship and leadership, since 2017.

In the reporting period, projects were implemented

across 27 states in Nigeria and three

countries in Africa. 17 non-governmental organizations

received grants in the areas of environment,

health, entrepreneurship and leadership. The targeted

number of beneficiaries impacted was about

304,760 lives.

Since the inception of this partnership with the

Foundation, about 990,265 individuals have been

impacted both directly and indirectly.

The ACT Foundation also supported the Private

Sector Coalition Against COVID-19 (CACOVID) and

made strategic plans for the grant received from

Novartis Nigeria for the implementation of ACT

Foundation’s quota in fighting the coronavirus pandemic.

The EndSARS is a decentralised social movement

against police brutality in Nigeria. The slogan

calls for an end to the Special Anti-Robbery Squad

(SARS), a notorious unit of the Nigeria Police Force

with a long record of abuses. In 2017, protests

started as a campaign on Twitter – with hashtag

#EndSARS – demanding that the Nigerian government

disbands the police unit. The movement

experienced a revitalization in October 2020, with

mass demonstrations across major cities in Nigeria.

Within a few days of renewed protests, the Nigeria

Police Force announced it was dissolving SARS on

Sunday, 11 October 2020, a move that was widely

received as a triumph of the protests.

However, the hijacking of the protest led to the loss

of lives, and destruction of properties and facilities.

Access Bank, as a responsible corporate citizen,

initiated the All4One Project. The focus of

the All4One project is to help local communities

to bounce back from the negative impact of the

protest. In addition, the All4One project is aimed

at impacting lives and businesses positively, rebuilding

communities and reviving communal spirit

amongst Nigerians.

The All4One project provided grants for individuals

and microbusinesses that have been impacted

negatively by the EndSARS protest. The grant program

has a two-pronged focus: individuals (indigents

individuals, students, unemployed individuals)

and microbusinesses (market women, caterers,

photographers, barbers, hairdressers and artisans). In

2020, 51 businesses were impacted with grants under

the All4One community grants.

Employee Volunteering Activities in Communities

Employee volunteering is an innovative way for organizations

to get their employees to be actively involved

in their contribution to the communities within

which they operate. Over the years, Access Bank has

encouraged its employees to carry out various activities

under its Employee Volunteering Scheme, where

employees are provided with guidance and advice on

the best avenues through which communities can be

impacted in various focus areas. Through this initiative,

Access Bank’s employees have contributed ideas,

skills and resources to address social, environmental

and economic issues, while being positive role models

to the people they engage in the communities.

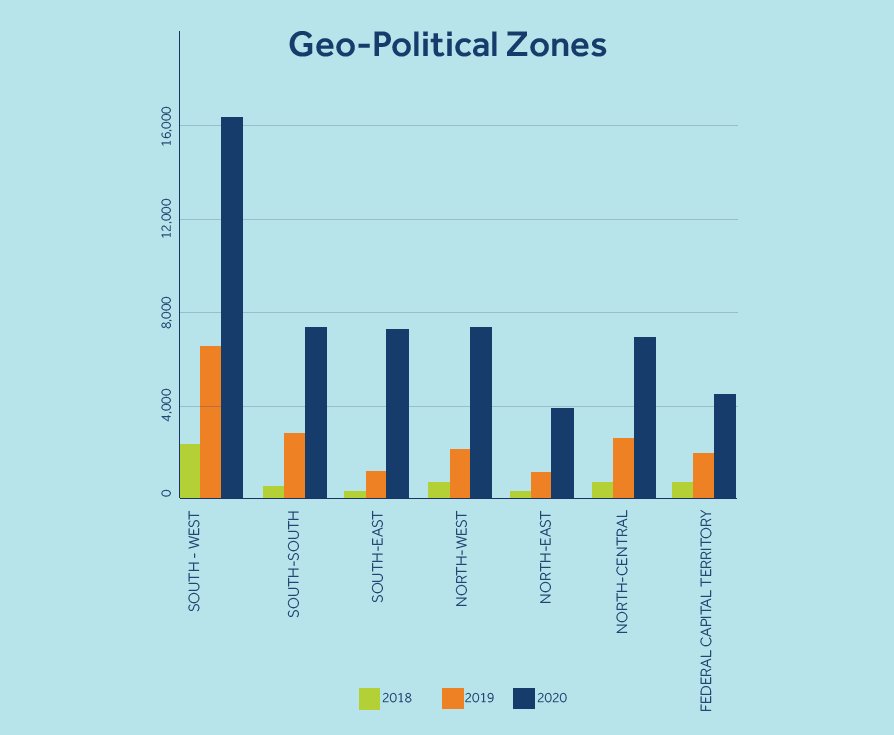

2020 was no different as all our employees across

different units of the bank carried out 514 strategic

community initiatives across all the six geo-political

zones of Nigeria while volunteering a total of

2,781,443 hours since 2015. This further expressed

their passion and commitment to community investment

as reflected in their choice of projects carried

out. Some of the notable initiatives from the 2020

Employee Volunteering Scheme are discussed below.

Conduct and Compliance

The Conduct & Compliance Group committed

2,500 hours and worked closely with Lagos State

Government agencies, including the Lagos State

Ministry of Education (Education Quality Assurance

Department, and Lagos State Universal Basic

Education Board (SUBEB)), and the Lagos State

Materials Testing Laboratory, to carry out a holistic

renovation of St. Peter Nursery/Primary School,

Ebute-Metta, Lagos State.

The group renovated the school buildings and enhanced

the infrastructure of the school, including

the complete transformation of old chalkboards to

marker boards. This project helped to support the

provision of quality education to about 500 otherwise

displaced pupils and a conducive working environment

for their teachers and non-teaching staff.

Internal Audit

The Internal Audit Group committed 2,118 hours

towards improving the learning environment for

students in Akodu Primary School Mushin, Lagos.

This was carried out by working closely with

the Community Chief and Chairman of the Mushin

Community Development Association and the

State Universal Basic Education Board (SUBEB). The

Group carried out a holistic renovation of classroom

blocks in the school, including the roofing of

three classrooms. This project had a direct benefit

for over 500 people by providing a conducive learning

environment and enhancing the academic performance

of the children.

The Information & Cyber Security Group committed

794 hours towards the ‘Kit A Child Initiative’, a

project focused on providing teaching and learning

materials, supporting quality education, and building

literacy skills of pupils. The project also enables

pupils to develop their cognitive, social and creative

skills, while building the capacity of teachers and

caregivers and ensuring that pupils have a fulfilling

and enjoyable experience while getting educated.

This project was carried out at All Saints Primary

School, Lagos and the Group partnered with Rhealyz

Africa to distribute health and safety materials,

learning materials and stationery, school bags and

other supplies to over 150 pupils in the school.

Human Resources & Executive Office

The Human Resources Group and the Executive

Office committed over 1,821 hours to cater to the

education of underprivileged children. This project

benefitted over 800 children across Nigeria and

was carried out in partnership with Bethesda Child

Support Agency, and it focused on the mentoring of

children, provision of educational materials and scholarships

for underprivileged children, as well as the provision

of feeding (1 meal per child, per day) and other

essentials.

Global Transaction Banking

The Global Transaction Banking Group committed

over 250 hours to the installation of renewable energy

solutions – quality solar power systems – at the Orile-

Agege Primary Health Centre. The project was aimed

at easing the effect of disrupted power supply on public

health centres, especially during the COVID-19 pandemic,

and will benefit 20,000 people over time.

Women in the Workplace

Access Women Network (AWN)

The Access Women Network was formed to support,

develop, promote and retain female employees in the

bank. Since the signing of the Female Network Charter

in 2010, there has been a positive trend in female

representation in the bank. In 2020, the bank’s workforce

was 53% women strong. This is a clear indication

that Access Bank is performing above the industry average

and as stipulated by the Nigerian Sustainable

Banking Principles, 30% of the Bank’s senior roles are

also occupied by women.

The AWN encourages female representation/inclusion

across all cadres of the bank. The Network provides

a support network especially to all female employees,

ensuring gender equality through policies

such as the Human Rights Policy (against harassment),

paternity leave, six months’ maternity leave, as

well as mentoring and leadership programmes.

In 2020, Access Women Network increased its efforts

to ensure that women across the Group were

positively impacted in one way or the other, especially

with a focus on minimizing the challenges of the

COVID-19 pandemic and its associated lockdown in

most areas of our operations. Some of the initiatives

of AWN in 2020 include:o AWN Toastmasters,

which continued at various times throughout the

year.

Project “Make a Family Happy” raised funds to

feed 500 families in June.

AWN webinar, titled, “The Future Is Female, Are

You Ready?”, held on July 29. The main speaker was

Audrey Mothupi, the Chief Executive Officer of the

Systemic Logic Group.

AWN Webinar, titled, “Making Your Money Work

for You”, held on September 11. The keynote

speaker at this event was James Maduekeh, and the

panellists were Ifueko Oduekun, Dharmit Cumar,

Franklin Ayensu-Nyarko, and Oluseun Onasoga.

Free Breast Cancer Screening for AWN members

held in October at selected locations.

Zaron Virtual Experience with AWN, a free online

makeup training, held on November 21.

The annual Orange Lecture held on November

25, themed, “Orange the World: Fund, Respond,

Prevent, Collect!”. Speakers at this session included

Justice Olubunmi Fadipe, Judge, Lagos State High

Court Division; Ini Abasi-Leye, Mental Health Therapist

and GBV Survivor; and the Bank’s Njideka Esomeju,

Head of Personal Banking Division.

Respond, Prevent, Collect!’. Speakers at this session

include Justice Olubunmi Fadipe, Judge, Lagos

State High Court Division, Ini Abasi-Leye, Mental

Health Therapist and GBV Survivor and the Bank’s

Njideka Esomeju, Head of Personal Banking Division.

Women in the Marketplace

The W Initiative

The W Initiative is the bank’s women’s market program

and has inspired, connected, and empowered

women in Africa for over 14 years. The initiative has

a strong presence in Nigeria, Ghana, Rwanda, and

Zambia with an array of offerings tailored to meet

the diverse career, business and lifestyle needs of

over 16 million female customers of all life and economic

stages.

Following the 2020 digital transformation strategy

for the bank, the ‘W’ branded debit card was introduced

to provide exclusive and convenient banking

for female customers. This led to a 65% increase in

debit card adoption by female customers and contributed

to generating over N102 billion ($255 million)

in deposit mobilization.

In the wake of the COVID-19 pandemic, a virtual

desk ‘W Cares’ was introduced to manage gender-

focused complaints and inquiries. Through

our eco-system management unit, we also created a

USSD option to automate collections for Faith-Based

Organizations during the nationwide lockdown.

To help facilitate women’s access to discounted finance,

we stimulated economic expansion by partnering

with Enterprise Sustainability Group (ESG) to

simplify the loan application process and tracking for

women in business. This resulted in over N8 billion ($20

million) debt financing investment in over 1,700 women-

owned enterprises and N18.8 billion ($47 million)

growth in lending to 750,000 female individuals.

To drive awareness and uptake of products, several

product-based campaigns were organized within the

year. These campaigns were conducted virtually, leveraging

social media as a major communication tool.

Some of these campaigns include the W Power Loan

campaign, MHSS campaign, channels adoption campaign

etc. Some of the flagship programs, activities,

and initiatives under the W Initiative in 2020 include:

Womenpreneur Pitch-a-ton Africa

The Womenpreneur Pitch-a-thon recorded 39,982

applications from eight African countries, provided

business capacity building for 50 female entrepreneurs

through a Mini MBA from the International Finance

Corporation (IFC) and produced five grant winners winning

a total of N9.25 million ($23,000.00).

W Webinar series

The W Webinar series is a capacity-building initiative

under the W Academy introduced in response to

the restriction of physical engagements due to the

COVID-19 Pandemic. 17 webinars were organized by

the W initiative with over 6,500 registered participants

from across 32 countries and four continents.

W Health Month

To commemorate W Health Month, we provided free

breast and cervical cancer screening as well as consultation

for 300 women across Lagos, Port Harcourt,

and Abuja.

Women-focused partnerships, alliances and subsidiary engagements

In 2020, we forged new strategic alliances with local

and international organizations such as Nigerian Governors

Wives Forum, Mastercard Foundation, FMO,

She Trades Invest, etc. These partnerships facilitated

a global recognition for Access Bank, as “Bank of the

Year” under the Non-financial Services category by

the Financial Alliance for Women.

The W initiative was also launched in new African markets

in 2020: Sierra Leone, DR Congo, Mozambique,

and The Gambia.

Looking to the next financial year, the W Initiative is

committed to sustaining the provision of suitable

financial and non-financial services that will enhance the lives of women across all life stages and increase their participation in the global economy.

End Female Genital Mutilation (FGM)

Female Genital Mutilation (FGM) is the ritual cutting

or removal of some or all of the external female genital.

FGM is a violation of human rights and poses a risk

to the lives and health of women and girls. Nigeria accounts

for 10% of global cases with Osun state having

the highest prevalence of circumcised women in the

country (77%), closely followed by Ebonyi (74%) and

Ekiti (72%) states.

In a bid to eradicate this harmful practice, Access Bank

partnered with HACEY Health Initiative to commemorate

the International Day of Zero Tolerance for FGM.

The program was held across Osun, Oyo, and Ekiti

states on February 6th, 2020. Traditional leaders as

well as government and community leaders were engaged

in dialogue sessions to advocate for the abandonment

of FGM practices in their communities.

Over 2,000 young girls, CBOs, traditional rulers and

policymakers participated in the programs across the

three states. About 500,000 Nigerians were reached

with online information, education and communication

materials.

International Women’s Day

Gender bias in Nigeria is not only stifling the growth of women but also constraining

the country’s ability to reach its potential. It has been proven that the country’s

Gross Domestic Product (GDP) could grow by 23% or $229 billion by 2025 if women

are allowed to participate in the economy to the same extent as men.

In a bid to accelerate the participation of women and girls in economic development,

Access Bank partnered with Xploit Consult, an organization that is focused on the

furtherance of the SDGs, to commemorate the 2020 International Women’s Day,

themed, “Each for Equal”. The program was themed ‘Women and Girls in Nigeria: Increasing

Participation in Mainstream Development.’ It attracted key stakeholders in

the gender and education spaces, including Mrs. Jokotola Akoni, Deputy Director,

Department of Archives, Federal Capital Territory Administration (FCTA); Mrs. Rashida

Apakhade, Deputy Director, Head Gender, Education Secretariat, FCTA; Mrs.

Stella Uzochukwu Denis, Entrepreneur/Engineer/Robotics Specialist; and Hajia Abdulhameed,

Auditor General, FCT Area Councils.

The program, also aimed at creating an action plan towards reducing the gender

gap in Nigeria by 2030, featured a workshop and an interactive panel session, which

was held in Abuja with female professionals and key stakeholders from all walks of

life. There was also an essay competition for female secondary school students with

the theme, ‘An Equal World: Fostering Economic Growth Through Equitable Participation’,

in which three schools came out tops and were rewarded with cash prizes.

A mentor-mentee platform was also created to match young girls with appropriate

female mentors who will guide their career paths. Over 83 participants benefited

from the programme, which also provided information on gender equality and women’s

rights.

Code4Impact

Access Bank partnered with HACEY Health Initiative

for the Code4Impact (C4i) Program, a learning program

developed to equip young women with digital

and analytical skills to enable them to pursue successful

careers in Science, Technology, Engineering

and Mathematics (STEM) fields. The programme is

aimed at encouraging more women to confidently

choose careers in STEM fields and build digital literacy

in web development, game development, mobile

app and microelectronics.

The program has been very successful such that it

has produced over 10,000 STEM professionals who

add and create value to the organizations that they

go on to join. It has also inspired the Nigeria Women

Techsters program, which has trained an additional

2,000 women and girls across Nigeria.

Back on Track Program

Access Bank Partnered with HACEY Health Initiative

for the Back on Track Program, a program focused

on empowering disadvantaged young girls

and women by providing them with vocational and

business skills, as well as information on sexual and

reproductive health and rights. The program aimed

to empower women and create opportunities for

them to live a healthy and productive life, and it

was held in Ebonyi State, Nigeria. 200 women were

trained in vocational, agriculture business, and life

skills, as well as in networking and marketing, business

management, and mentoring. These skills enabled

the women to set up their businesses in the

production of soap and disinfectants.

International Day of the Girl Child

The United Nations General Assembly declared October

11th as the International Day of the Girl Child

on 19th December 2011, in recognition of girl’s

rights and the unique challenges girls face around

the world. The International Day of the Girl Child

focuses attention on the need to fulfil the human

rights of girls, promote girl empowerment and address

the challenges faced by girls around the world.

To commemorate this day in 2020, Access Bank

partnered with HACEY Health Initiative, a development

organization focused on improving the health

and productivity of underserved populations in Africa.

The Day was themed “My Voice, Our Equal Future”,

and it featured an essay competition for secondary

school students, a safe space leadership and

health workshop for girls, media awareness on promoting

the health and productivity of women and

girls in Nigeria, and the establishment of a media lab

– the first studio in Nigeria dedicated to amplifying

the voice of young girls, training young girls to leverage

on digital media tools to amplify their voices.

The essay competition had over 1,000 entries and

10 best essay submissions were selected. Of the 10

shortlisted essays, three winners emerged: Miss Teniola

Olatunji from Holy Saviour’s College as second

runner up, Miss Shobanjo Adeola from Itolo Girls Junior

Secondary School as first runner up, and Miss Chijindu

Ndubisi from Nigeria Navy Secondary School as

the winner. 3,815 young girls were also reached with

safe space leadership, health & productivity messages

– both online and offline – through workshops, and 30

secondary school visitations.

16 Days of Activism Against Gender-Based Violence

The 16 Days of Activism Against Gender-Based Violence

is an annual international campaign that kicks

off on November 25th, the International Day for the

Elimination of Violence Against Women, and runs until

December 10th, Human Rights Day. The campaign

is aimed at raising awareness on the prevention and

elimination of violence against women and girls.

Access Bank partnered with HACEY Health Initiative, a

health-focused organization to accelerate programs

aimed at ending gender-based violence in Nigeria. The

programs for the 16 Days of Activism included:

The launch of the End Rape Culture website aimed at

promoting messages and stories that encourage

survivors to report and increase awareness.

A Kick-out Gender-Based Violence Campaign

targeted at game lovers and using the launch of

FIFA 21 as a springboard to generate discussions

on ending gender-based violence.

Online summits & exhibitions, including a webinar

held on challenges and opportunities to leverage

innovation and technology to end gender-based

violence.

Media rounds aimed at raising awareness on different

forms of violence against women and girls’

platforms.

The end rape culture exhibitions had 402 participants,

while the end rape culture and gender-

based violence webinar had 319 participants.

The game competition designed to engage young

men on ending rape culture directly reached 297

young men, and the whole campaign reached a total

of 205,000 people via social media and a feature

on Arise TV.

Environmental Stewardship

As an environment conscious bank, Access Bank

has embedded environmental sustainability in its

sustainability strategy, which is approved by the

Board and integrated into its financing decisions.

We have constantly demonstrated our commitment

to environmental protection through our

strong advocacy for environmental conservation

and working in partnership with stakeholders to

collectively tackle issues concerning our shared

environment.

We continued to comply with environmental protection

laws and standards in 2020. We are also

making conscious efforts to curb our greenhouse

gas emissions through initiatives that are

directed at reducing our diesel consumption and

supplementing power supply with solar power

across our various business locations. We maintained

and consolidated our efforts towards reducing

our water consumption, paper use and

waste-to-landfill. The Bank also included environmental

impact assessments and audits of prospective

projects in our carbon footprint reduction

strategy.

Our 2020 environmental performance mirrored

the unexpected positive impact of the coronavirus

pandemic on the environment as experienced globally.

A lot of our consumption indices were drastically

lower, compared to those of 2019. We heavily leveraged

our travel emission reduction strategy by applying

our use of video conferencing to all our work

processes as necessitated by the global lockdown

and subsequent ‘work-from-home’ mandate.

These and other initiatives detailed below ensured

that every unit and process of the bank contribute

to a low carbon economy.

Sustainable Waste Management

We initiated our sustainable waste management

program in 2016 and since then, we have been

championing sustainable waste management in our

key locations, including our Head Office. The incorporation

of recycling has been an integral component

of our sustainable waste management program

and enables us to significantly reduce the

volume of waste that we send to the landfill. Recyclable

waste materials such as paper, aluminium

cans, plastic, glass, and cartons are sorted from over

80 branches and picked up by our recycle partners,

RecyclePoints and ParallelPoint Consult.

To ensure the success of this program, the bank invests

in regular training for all cadre of staff to further

ingrain the benefits of the program and give the

staff a sense of shared responsibility and ownership of

the program. We also upgraded the trucks of the recycling

partners to maximize their capacity and improve

their efficiency in carrying out their function.

We further demonstrated our commitment to sustainable

waste management during the 2020 edition of the

Access Bank Lagos City Marathon, as our recycle partners

were present along the marathon route and at the

finish line to ensure that polyethylene terephthalate

(PET) bottles were picked up and not sent to the landfill.

All of these, and more, enabled the bank to carry out its

responsibility of protecting the environment through

sustainable waste management.

Alternate Energy

The importance of energy cannot be overemphasized

and that is why we have invested in alternative sources

of energy over the years and as a result:

- 605 of our automated teller machines (ATMs) nationwide

are solar powered

- 58 branches are powered by hybrid power sources

All our bank facilities are lit by LED lights

- The Head Office is fitted with motion-sensitive lights

and water-efficient taps

We regularly report, monitor, and evaluate our electricity

consumption across all our branches.

These efforts have contributed to reducing our carbon

emissions, demonstrating our commitment as an organization

to reducing our negative impact on the environment.

Resource Efficiency

We continued to implement processes that help us improve

efficiency and limit our impact on the environment.

One of such initiatives is our ‘No Paper Initiative’,

which helps us to reduce our paper consumption. The

following are activities under the initiative:

- Paper Saving Tips

- Automated Memo Approval System on

ProcessMaker

- Automated Payment System on Dynamic 365

- Use of Diligent BoardBook – an automated and secured

system that has helped to significantly reduce

the number of documents printed for Board meetings.

Water Efficiency

As an advocate of water conservation, the Bank installed

water-efficient flush systems and taps. We also

conduct innovative campaigns and communications

using videos and factsheets to keep staff members in

constant awareness of the need for water management.

Supply Chain

Access Bank’s suppliers are central to our business as

they supply the tools, goods, and services we require to

run our operations effectively and seamlessly, as well as

meet the needs of other stakeholders. We require our

suppliers to deliver high quality products and services,

while making positive contributions to the environment

and society at large. This is in conformance to the United

Nations Global Compact Principles which the bank

is subscribed to.

Vendor Selection Process

Our procurement policy is broad-based, covering the

various areas the bank operates in and hinges on ensuring

that our stakeholders’ concerns are taken into

consideration.

We require our vendors to observe high ethical standards,

as well as ensuring that they take responsibility

as corporate citizens. This is why we structured

our procurement framework to ensure that we carry

out extended due diligence in co-ordination with the

end-users to ensure long term sustainability. Vendors

are engaged according to their capacity and categorized

to accommodate vendors of various economic

strengths.

All our vendors are assessed based on the following criteria:

i. Quality of goods/services

ii. Geographical coverage

iii. Track record

iv. Price competitiveness

v. Problem resolution

vi. Referrals from other institutions

vii. Timeliness of service delivery

viii. Risk assessment

ix. Business sustainability

Local Sourcing

We recognize the complexities associated with

sourcing, such as carbon emissions, violation of

human rights, and potential biodiversity loss. This

is why we encourage our suppliers to source goods

from trustworthy sources closest to the bank as

this not only helps us eliminate the aforementioned

risks, but also ensures the growth of the

local economy and provides an enabling environment

for businesses to thrive.

In 2020, we spent about N197 billion engaging over

100 suppliers across all geopolitical zones in Nigeria.